Introduction

Following the recent event over the weekend (27/28 June 2015), we set out below a short guide on the current status in Greece.

Background

Months of negotiations on a deal to restructure Greece’s debts appear to have failed. Greek Prime Minister Alexis Tsipras has called a referendum for 5 July 2015 on the draft bailout proposals (the “Proposals“) from the EU[1]. Mr Tsipras government will campaign against the Proposals which required a number of measures relating to VAT increases, budgetary restraints, pension reforms and privatisation measures. On Saturday 27 June 2015 Eurozone finance ministers refused to extend the current EU bailout programme which expires on 30 June 2015. In response on Sunday 28th July 2015 the Greek government announced the imposition of capital controls.

IMF Payment and ECB Repayments

The final €7.2bn (£5bn; $8bn) of Greece’s EU bailout installment has been frozen since last August 2014.

Greece is due to make a €1.6bn (£1.1bn) payment to the International Monetary Fund (“IMF“) on Tuesday (30 June 2015) – which is the same day that its current bailout programme expires. It is hard to foresee a realistic scenario where this payment will be made on the due date. In addition, another payment is due to the ECB, of €3.5bn repayment, on 20 July 2015. In recent months, Greek banks have been kept on life support by drawing down under the ECB’s Emergency Liquidity Assistance (“ELA“) programme. However the rules governing the ELA mean further draw downs cannot be made if the ECB considers Greek banks to be insolvent.

Role of ELA

€89bn under the ELA programme has been made available to Greek banks given the massive withdrawals which have been made since the renegotiations on a new Greek bailout began (by the end of May 2015 private sector deposits in Greek banks had fallen to €130bn from €164bn in November 2014). ELA is exceptional funding which is not provided under the ECB’s usual direct refinancing operations. Whilst collateral is required for ELA funding the quality of such collateral is not of the same quality than would be required for the ECB’s other facilities. On Saturday 27 June 2015 the ECB announced it would cap its ELA programme rather than increase it to cover emergency assistance for the banks which meant given, the velocity of cash withdrawals in recent days and in the absence of other sources of liquidity, capital controls became inevitable.

Referendum

Following the failure to agree on Friday 26 June 2015 at a meeting between the Greek finance ministers and the Euro Finance ministers, Prime Minister Alexis Tsipras’s government announced that it would hold a referendum for the Greek people to vote on the Proposals. The Prime Minister announced his government would campaign against the Proposals. Rather confusingly the EU appears to have taken the proposed bailout offer off the table and so the Greek people face the prospect of voting in a referendum on a deal which is not technically available.

What Are the Details of the Capital Controls?

The picture is somewhat confused and at the time of writing we are aware of no specific laws released by the Greek government, but we would expect measures such as:

- Limits[2] on the amount of money individuals and businesses can withdraw or transfer overseas.

- a daily limit on transfers from banks

- prohibitions on the cashing of cheques.

We would expect that any breach of such controls will be made a criminal offence in Greece. The Greek banks are currently expected to be closed until 6 July 2015, the day after the proposed referendum.

Capital Control Precedents: Cyprus 2013

In 2013 controls were imposed in Cyprus which provided that Cypriots could only withdraw Euros 300 per day.

In addition Cypriots travelling abroad could only take €1,000 out of the country, while payments and/or transfers outside Cyprus via debit and/or credit cards was permitted only up to €5,000 per month.Capital controls were lifted in April 2015. Iceland provides another recent example of the imposition of capital controls which were put into effect in 2008 at the height of the financial crisis. These remain in effect to this day although Iceland has recently announced its intention to release these controls in the near future.

There was a €5,000 per day limit for businesses, and a committee was set up to review commercial transactions between €5,000 and €200,000. That committee also had to approve all commercial transactions over €200,000 on a case-by-case basis.

Eurozone Exit?

Capital controls undermine one of the key founding concepts of the EU – the free movement of capital. However in the case of Cyprus which remains in the Eurozone, the European Commission permitted the imposition of such controls to prevent destabilisation of the European economy. Article 63 of the Treaty on the functioning of the European Union (TFEU), prohibits the imposition of restrictions on the movement of payments and capital between EU Member States. One of the exceptions to this requirement is that each Member State has the right to “take measures which are justified on the grounds of public policy or public security” (Article 65(1) of TFEU).

The imposition of capital controls and even a default of payments to the IMF does not inevitability mean that Greece will leave the EU. There is no specific mechanism envisaged for an exit. ECB Vice President, Vitor Constancio, stated in April 2015 that if Greece defaulted on its debt there was no legislation that required its expulsion.

Long Term Implications

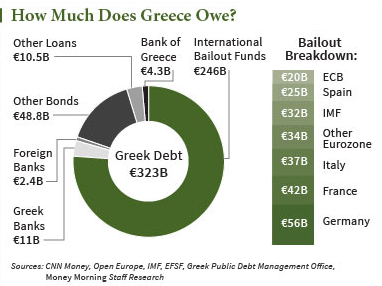

We cannot predict the affect that the situation will have on market sentiment. It is notable however that the main creditors of Greece are the IMF and the ECB. The private sector (mainly in the form of hedge fund bondholders) is owed only 15% of the total approximately €320bn of Greek debt.

How much does Greece owe (as of March 2015)?

Default would mean a sizeable loss for the ECB, which is owed €118bn from Greek banks, although the ECB does hold collateral in support of these loans. For the Greek economy the picture is highly fluid. There is an undeniable risk that Greece will be forced to exit the EU. It is conceivable that notwithstanding that Greece defaults on the upcoming IMF payment and long term capital controls are imposed Greece can stay within the Eurozone. If the referendum goes ahead and the result is an acceptance of the Proposals it will be hard to see how the current government (which will recommend a rejection of the currently proposed deal) will survive. In this scenario a new government might take control and the negotiation might start again.

Questions

At the moment, it is hard to get a clear overview of how the situation plays out. However, a number of questions immediately arise:

- Will the ECB seek to call a cross default in the event the IMF payment is missed?

- How will the Credit Default Swaps market react and specifically will the failure to make the IMF payment be deemed to be a CDS trigger event for Greek debt?

- How will the ECB react to stabilise the market, will the current quantative easing programme be stepped up?

- Will the ECB maintain its current position that its Proposals are off the table if the Greek people vote in favour of implementing the Proposals?

Conclusion

Market participants, regulators and the ECB will continue to monitor the sitution carefully. It should be remembered that the exposure of EU banks and other private sector players to the Greek system is limited. We would expect the ECB/IMF will be working hard to ensure that a Greek crisis does not turn into a wider systemic crisis.

[1] http://europa.eu/rapid/press-release_IP-15-5270_en.htm

[2] Media reports would suggest a limit of €60 is being imposed.