Think Your Workers are Independent Contractors? Not So Fast Says the DOL

5 minute read | July.24.2015

On July 15, 2015, the U.S. Department of Labor (“DOL”) issued an Administrator’s Interpretation that purports to clarify on one of the most challenging legal questions facing employers today: are certain workers employees or independent contractors? Notably absent from the guidance, however, is any specific reference to workers who provide services through “on-demand” companies like Uber, Lyft, and Airbnb who use technology to deliver traditional services more efficiently by connecting consumers directly with service providers. This is surprising since it seems that the DOL’s renewed focus on misclassification has stemmed in large part from the slew of pending on-demand worker lawsuits in which the classification tests have proven very difficult to apply.

That said, the DOL left no doubt that it is taking a hard stance on misclassification of workers in all industries. The DOL seizes upon the definition of “employ” under the Fair Labor Standards Act (“FLSA”)—“to suffer or permit to work”—and concludes that “most workers are employees under the FLSA.” The Administrator’s Interpretation is effective immediately, without any notice and comment period, which raises serious questions as to whether any court should adopt the Interpretation. But at least for now, the guidance provides more insight into how the DOL will analyze worker classification, and any entity that engages independent contractors should take notice.

At first blush, the guidance sounds remarkably familiar to efforts we’ve seen recently in California to broaden the definition of employee using the “suffer or permit to work” standard. In Dynamex Operations West v. Superior Court, the California Supreme Court is scheduled to review a California appellate court’s decision that concludes that any business that “suffers or permits” a worker to provide services is an employee. The appellate court concluded that the suffer-or-permit standard merely requires showing that the company either: (1) knew or should have known that the contractors were provided services; or (2) had the authority to negotiate the amount it would pay the contractors for their services. Critically (and erroneously) the appellate court abandoned all other tests of employment in favor of this overbroad standard, which originally arose from the child labor laws and was designed to determine whether two entities are joint employers, not whether an individual is an employee or a contractor.

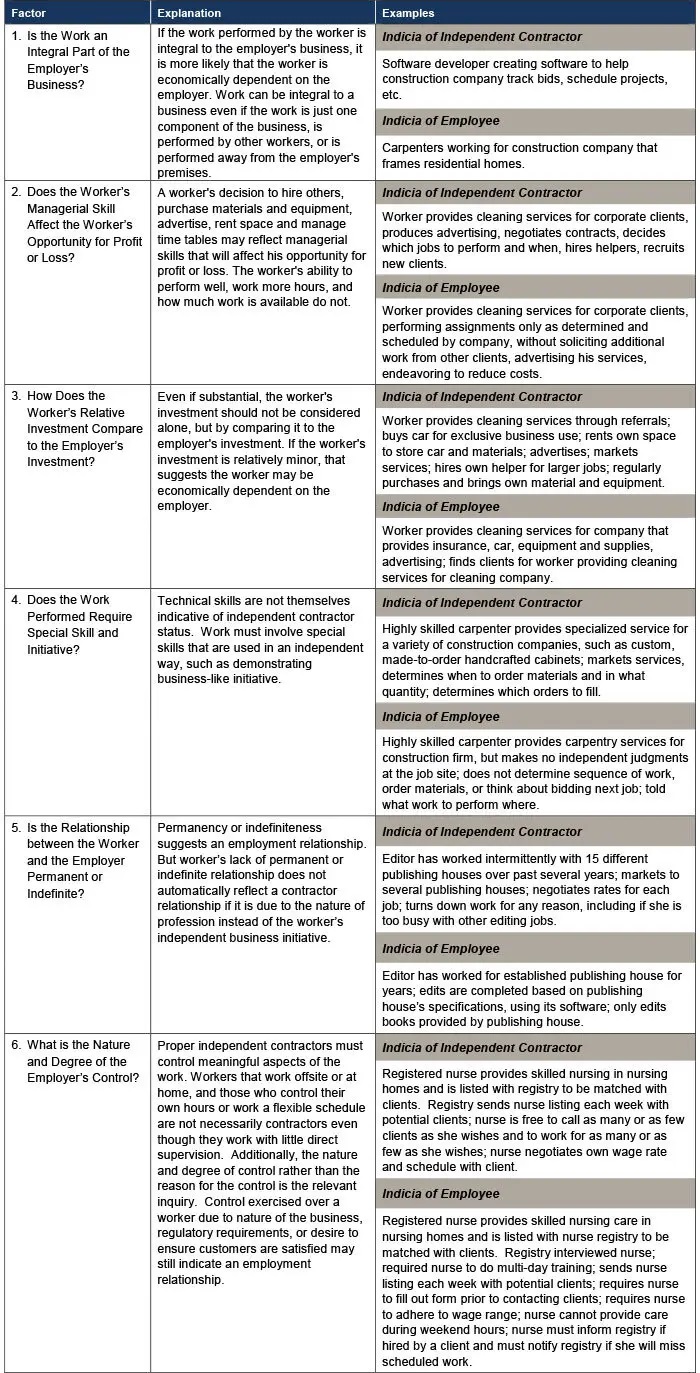

Fortunately, the DOL stops short of taking the “suffer or permit” standard that far. But its decision to tie the “suffer or permit” standard to the economic realities test, which has been the standard for employee classification under the FLSA for decades, is troubling. According to the guidance, “an entity ‘suffers or permits’ an individual to work if, as a matter of economic reality, the individual is dependent on the entity.” This is not simply a matter of the entity knowing that the worker is providing services or having the authority to negotiate pay (the standard before the California Supreme Court in Dynamex). Rather, the DOL crafts the key question as whether the worker is truly in business for himself (i.e., an independent contractor) or whether, as a matter of economic reality, the worker is economically dependent on the company (i.e., an employee). To make this determination, courts have historically relied on the following six factors:

- the extent to which the work performed is an integral part of the company’s business;

- the worker’s opportunity for profit or loss depending on his or her own managerial skill;

- the extent of the relative investments of the company and worker;

- whether the work requires special skills and initiative;

- the permanency of the relationship between the company and worker; and

- the degree of control exercised by the company.

The Administrator acknowledges the flexibility in the test, noting that these factors should not be “analyzed mechanically or in a vacuum, and no single factor, including control, should be over-emphasized.” Some might prefer the predictability of a more rigid test, but this fluidity arguably allows the test to adapt over time, which is critical in such a rapidly changing economy. It also makes it harder to litigate misclassification on a class-wide basis if the degree to which any given worker meets each factor differs from individual to individual.

The bulk of the Administrator’s Interpretation consists of several examples reflecting what type of work the DOL considers to be employment versus the work of a contractor, as summarized in the chart below.

Time will tell whether courts choose to adopt the Administrator’s unilateral interpretation of these standards, but in the meantime, businesses should analyze these examples carefully when evaluating the classification of its workers. Of course, the examples provided by the Administrator are not exhaustive and still leave many questions unanswered. A proper analysis of worker classification should look carefully at the facts specific to each case, should address the various state laws and local ordinances that may also apply, and should be conducted with legal counsel to preserve the attorney client privilege.