On November 2, 2017, House Ways and Means Committee Chairman Kevin Brady (R-TX) introduced a tax bill entitled the Tax Cuts and Jobs Act, and later proposed amendments to the bill on November 3, November 6, and November 9, 2017. The House passed the amended version of the bill on November 16, 2017. On November 9, 2017, Senate Finance Committee Chairman Orrin Hatch (R-UT) released a Senate version of the bill, and later proposed amendments to the bill on November 14, 2017. On November 16, 2017, the Senate Finance Committee approved the bill after making some last minute changes in a manager’s amendment. The Senate is expected to take action on its version of the bill sometime after the Thanksgiving break. If the bill is passed by the Senate, the conference committee will attempt to reconcile the House and Senate versions of the bill. If the bill were to become law, there would be certain fundamental changes to the taxation of financing transactions.

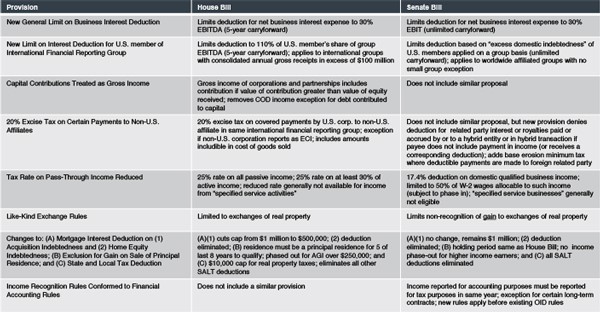

Click the chart above to view a larger version

A brief summary of the comparison of the impact of the House and Senate versions of the bill on financing transactions is available here. A more detailed version of such comparison is available here.

Please feel free to contact a member of the Orrick Tax practice group for further up-to-date details as these developments continue to unfold.