On May 13, 2015, the Securities Exchange Commission (“SEC”) proposed a rule and rule amendments relating to certain security-based swaps[1] arranged, negotiated, or executed by U.S. personnel (the “Proposed Rule”).[2]

This proposed rule governs, among other things, the SEC regulation of a security-based swap that is (i) entered into between two non-U.S. persons but (ii) “arranged, negotiated, or executed by personnel located in a U.S. branch or office or in a U.S. branch or office of an agent.” The proposed SEC security-based swap regime generally would apply to such a security-based swap in the following manner:

- Dealing activity in the security-based swap would count toward the threshold for the de minimis exemption from security-based swap dealer registration.

- If either party is a registered security-based swap dealer, the SEC’s external business conduct requirements would apply to the security-based swap.

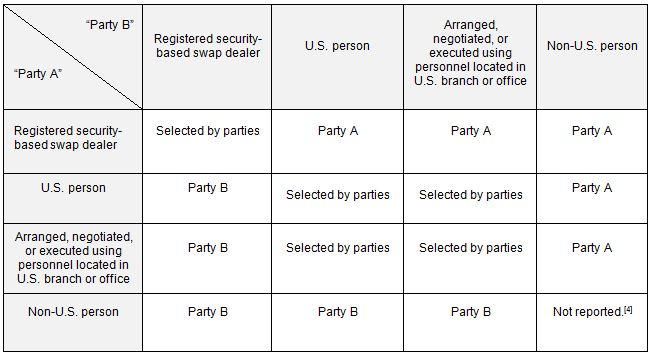

The reporting requirements—but, notably, not the clearing or trade execution requirements—would apply to the security-based swap. Together with the SEC’s various other cross-border rules (some of which remain in proposed form and others of which have been finalized), the Proposed Rule indicates how the “reporting side” (i.e., the counterparty that has the duty to report) to a security-based swap would be determined, as summarized by the following table:[3]

Additionally, the reporting requirements would apply to any security-based swap executed on a platform having its principal place of business in the United States or effected by or through a registered broker-dealer (including a registered security-based swap execution facility).

[1] “Security-based swaps” are defined under the Wall Street Transparency and Accountability Act of 2010 to include, inter alia, swaps based on any of: (i) a narrow-based security index, including any interest therein or on the value thereof; (ii) a single security or loan, including any interest therein or on the value thereof; or (iii) the occurrence, nonoccurrence, or extent of the occurrence of an event relating to a single issuer of a security or the issuers of securities in a narrow-based security index, provided that such event directly affects the financial statements, financial condition, or financial obligations of the issuer.

[2] Application of Certain Title VII Requirements to Security-Based Swap Transactions Connected with a Non-U.S. Person’s Dealing Activity That Are Arranged, Negotiated, or Executed By Personnel Located in a U.S. Branch or Office or in a U.S. Branch or Office of an Agent, 80 Fed. Reg. 27,444 (May 13, 2015).

[3] The parties specified in the table, more specifically, are: a registered security-based swap dealer; a U.S. person (other than a registered security-based swap dealer); a counterparty (other than a registered security-based swap dealer or U.S. person) that arranges, negotiates, or executes the swap using personnel located in U.S. branch or office; and a non-U.S. person (other than a registered security-based swap dealer or counterparty that arranges, negotiates, or executes the swap using personnel located in U.S. branch or office).

[4] Such a security-based swap is not required to be reported by either party unless: (i) executed on a platform having its principal place of business in the United States; or (ii) effected by or through a registered broker-dealer (including a registered security-based swap execution facility). Regarding (i), if the security-based swap will not be submitted to central clearing, the platform would have no reporting obligation, and so, it appears that the reporting side would be selected by the parties. By contrast, if the security-based swap will be submitted to central clearing, the SEC has not yet articulated which party would have the reporting obligation. Regarding (ii), the registered broker-dealer would be responsible for reporting.