On July 13, 2016, the Securities Exchange Commission (“SEC”) approved certain amendments and guidance to the rules governing the reporting and public dissemination of security-based swaps (“SBS”), known as “Regulation SBSR,”[1] which were adopted in February 2015. The amendments and guidance are intended to increase transparency in the SBS market.

Generally, Regulation SBSR provides for the reporting of SBS information to registered security-based swap data repositories (“SBSDRs”), as well as the public dissemination of SBS transaction data. The amendments and guidance address certain open issues in the Regulation SBSR adopting release, and also clarify how Regulation SBSR would apply to SBS activity engaged in by non-U.S. persons within the United States.

Among other things, the amendments and guidance:

- Establish a compliance schedule for certain portions of Regulation SBSR for which no compliance dates were specified in the Regulation SBSR adopting release.

- Establish SBSDR reporting and public dissemination requirements for certain cross-border SBS, including requiring any SBS transaction connected with a non-U.S. person’s SBS dealing activity that is arranged, negotiated, or executed by personnel of such non-U.S. person located in a U.S. branch or office—or by personnel of its agent located in a U.S. branch or office—to be reported and publicly disseminated.

- Assign the reporting duties for platform-executed SBS that will be submitted to clearing and for SBS resulting from the clearing process.

- Prohibit SBSDRs from imposing fees or usage restrictions on the SBS transaction data that Regulation SBSR requires them to publicly disseminate.

- Require a national securities exchange or “security-based swap execution facility” to report an SBS executed on the platform that will be submitted to clearing.

- Require a registered clearing agency to report any SBS to which it is a direct counterparty, as well as whether or not the clearing agency accepts a transaction for clearing.

- Provide guidance regarding the application of Regulation SBSR to SBS resulting from prime brokerage arrangements and from the allocation of cleared SBS.

Additional details on the important first two items addressed by the amendments and guidance follows.

(a) Compliance dates

Regulation SBSR, as modified by the amendments and guidance, provides for the following compliance dates for the reporting and dissemination of SBS information:

- “Compliance Date 1” (i.e., the date on which persons with a duty to report SBS will be required to report all newly-executed SBS in the relevant asset class to an SBSDR) will be the first Monday that is the later of: (i) six months after the date on which the first SBSDR that can accept transaction reports in that asset class registers with the SEC; and (ii) one month after the compliance date for “security-based swap dealer” (“SBSD”) registration. (Note that the compliance date for SBSD registration will not take place until after certain fundamental rules applicable to SBSDs – including capital, margin and segregation – are finalized.)

- “Compliance Date 2” (i.e., the date on which registered SBSDRs that can accept SBS in a particular asset class must begin public dissemination of transactions in that asset class) will be the first Monday that is three months after Compliance Date 1.

- “Compliance Date 3” (i.e., the date on which persons with a duty to report SBS will be required to report to an SBSDR all SBS in the relevant asset class that were executed prior to Compliance Date 1 but existed on or after July 21, 2010, also known as “historical” SBS) will be two months after Compliance Date 2.

(b) SBSDR reporting of certain cross-border SBS transactions

The Regulation SBSR adopting release sought public comment on, among other issues, how the SBSDR and public dissemination reporting requirements should apply to: (i) SBS where there is no U.S. person, registered SBSD, or registered major security-based swap participant on either side of the transaction; and (ii) SBS where there is no registered SBSD or registered major security-based swap participant on either side of the transaction and there is a U.S. person on only one side of the transaction.[2] The amendments and guidance provide rules governing these circumstances.

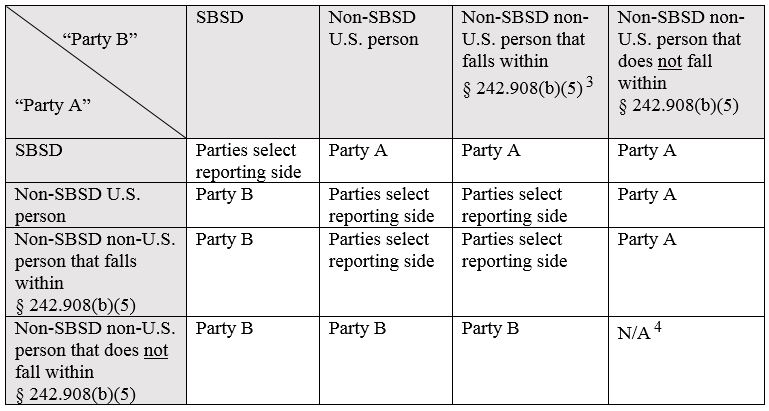

The table below summarizes the applicability of the SBSDR reporting requirements to various types of cross-border uncleared, off-exchange SBS under Regulation SBSR, as modified by the amendments and guidance. The table also indicates, for each type of cross-border SBS, the “reporting side” of the transaction responsible for compliance with the SBSDR reporting requirements.

[1] Regulation SBSR—Reporting and Dissemination of Security-Based Swap Information, 80 Fed. Reg. 14,564 (March 19, 2015).

[2] Id. at 14,568.

[3] A non-U.S. person that falls within § 242.908(b)(5) is one that, “in connection with such person’s SBS dealing activity, arranged, negotiated, or executed the SBS using its personnel located in a U.S. branch or office, or using personnel of an agent located in a U.S. branch or office.”

[4] A SBS between two non-SBSD non-U.S. persons that do not fall within § 242.908(b)(5) will, nevertheless, be subject to the reporting requirements if effected by or through a registered broker-dealer, in which case the broker-dealer will act as the reporting side.