On April 18, 2017, the Commodity Futures Trading Commission (“CFTC”) issued a no-action letter extending until November 7, 2017 the relief provided under CFTC Letter No. 17-05 (“Letter 17-05”), which was scheduled to expire on May 8, 2017.[1] Letter 17-05 provides relief from certain CFTC margin requirements to certain swap dealers (“SDs”) in connection with swaps subject to the margin requirements under the European Market Infrastructure Regulation (“EMIR”).

Letter 17-05 permits SDs that are subject to both CFTC and EMIR margin requirements to comply only with EMIR in cases where the CFTC’s cross-border margin final rule from May 2016 (the “Cross Border Margin Rule”) indicated that substituted compliance may be available.[2] Substituted compliance generally permits an entity that is subject to both CFTC requirements and comparable requirements under a different jurisdiction to comply only with such comparable requirements of the other jurisdiction. However, before an entity may comply in this manner, the CFTC first must make a specific “determination” that the relevant requirements of the other jurisdiction are comparable to those of the CFTC. The Cross-Border Margin Rule indicated that substituted compliance may be available in certain cases upon such a “comparability determination,” but, to date, no comparability determinations have been made. Thus, Letter 17-05 permits SDs subject to both CFTC and EMIR margin requirements to comply only with applicable EMIR requirements, to the extent permitted under the Cross Border Margin Rule, as though a relevant comparability determination had been made.

The Cross Border Margin Rule provides that substituted compliance (upon a comparability determination) is generally available to SDs in the following cases:

- For either a U.S. SD or a U.S.-guaranteed SD, substituted compliance is available (upon a CFTC comparability determination) with respect to the initial margin that such party posts (but not the initial margin that such party collects or variation margin) in a swap with a non-U.S. person not guaranteed by a U.S. person.

- For a non-U.S. SD not guaranteed by a U.S. person, substituted compliance is available (upon a CFTC comparability determination) for any swap that would be subject to the CFTC margin rules, unless the counterparty is either a U.S. SD or a U.S.-guaranteed SD, in which case the substituted compliance is available only with respect to the initial margin that the counterparty posts (but not the initial margin that such counterparty collects or variation margin).[3]

Notably, the prudential regulators have not, to date, provided similar relief. Thus, the foregoing relief is available only for non-bank SDs regulated by the CFTC for purposes of the margin requirements.

[1] CFTC Letter No. 17-22 (April 18, 2017); CFTC Letter No. 17-05 (February 1, 2017).

[2] Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants—Cross-Border Application of the Margin, 81 Fed. Reg. 34,818 (May 31, 2016).

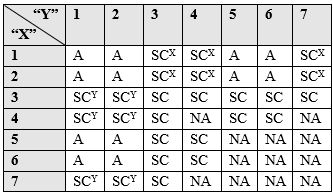

The following table provides a high-level, general summary of the framework under the final rule:

As used above:

1 = U.S. swap dealer

2 = Non-U.S. swap dealer (including, without limitation, (i) a U.S. branch of such non-U.S. swap dealer or (ii) a non-U.S. swap dealer that is consolidated in the financial results of a U.S. parent) that is guaranteed by U.S. person

3 = Non-U.S. swap dealer that (1) is a U.S. branch of such non-U.S. swap dealer or is consolidated in the financial results of a U.S. parent and (2) is not guaranteed by U.S. person

4 = Non-U.S. swap dealer that (1) neither is a U.S. branch of such non-U.S. swap dealer nor is consolidated in the financial results of any U.S. parent and (2) is not guaranteed by U.S. person

5 = U.S. non-swap dealer

6 = Non-U.S. non-swap dealer that is guaranteed by U.S. person

7 = Non-U.S. non-swap dealer that is not guaranteed by U.S. person

A = CFTC rules are applicable

NA = CFTC rules are not applicable

SCX = CFTC rules are applicable but substituted compliance is available with respect to the initial margin that Party X posts (but not the initial margin that Party X collects or variation margin)

SCY = CFTC rules are applicable but substituted compliance is available with respect to the initial margin that Party Y posts (but not the initial margin that Party Y collects or variation margin)

SC = CFTC rules are applicable but substituted compliance is available

The following clarifications should be noted:

- Each of the above references to a “swap dealer” refers to a non-bank swap dealer registered with the CFTC. (The prudential regulators – i.e., the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Farm Credit Administration, and the Federal Housing Finance Agency – have jurisdiction over the margin requirements applicable to bank swap dealers.)

- The final rule defines ‘‘guarantee’’ as an arrangement pursuant to which one party to a swap transaction with a non-U.S. counterparty has rights of recourse against a U.S. person guarantor (whether such guarantor is affiliated with the non-U.S. counterparty or is an unaffiliated third party) with respect to the non-U.S. counterparty’s obligations under the relevant swap transaction.

- Substituted compliance is available only in a jurisdiction whose laws the CFTC has deemed comparable. Otherwise, substituted compliance would not be available and the CFTC rules would apply.

- U.S. or non-U.S. status is determined by a particular “U.S. person” definition included in the final rule, rather than by the definition used in the CFTC’s cross-border guidance from July 2013.

- The final rule imposes margin requirements on certain inter-affiliate swaps between (i) a non-U.S. swap dealer that is (x) not guaranteed by a U.S. person and (y) not a U.S. branch of, or consolidated with, a U.S. person and (ii) a non-U.S. non-swap dealer that is not guaranteed by a U.S. person.

[3] For additional detail, see note 2 supra.