In July, the CFTC proposed a rule for the application of its uncleared swap margin requirements to cross-border swap transactions.[1] The CFTC recognized that a cross-border framework for margin “necessarily involves consideration of significant, and sometimes competing, legal and policy considerations.” However, in developing the proposed rule, it noted that it was attempting to balance those considerations to effectively address the risks posed to the safety and soundness of swap dealers and major swap participants, while also establishing a workable framework.[2] The following table provides a high-level, general summary of the framework under the proposed rule:

1 = U.S. swap dealer[3]

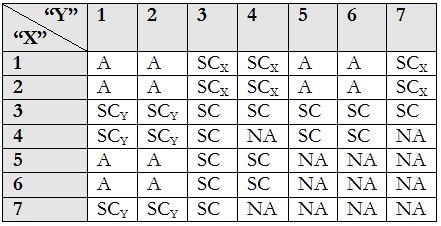

2 = Non-U.S. swap dealer (including, but not limited to, (i) a U.S. branch of such non-U.S. swap dealer or (ii) a non-U.S. swap dealer that is consolidated in the financial results of a U.S. parent) that is guaranteed by U.S. person

3 = Non-U.S. swap dealer that (1) is a U.S. branch of such non-U.S. swap dealer or is consolidated in the financial results of a U.S. parent and (2) is not guaranteed by U.S. person

4 = Non-U.S. swap dealer that (1) neither is a U.S. branch of such non-U.S. swap dealer nor is consolidated in the financial results of any U.S. parent and (2) is not guaranteed by U.S. person

5 = U.S. non-swap dealer

6 = Non-U.S. non-swap dealer that is guaranteed by U.S. person

7 = Non-U.S. non-swap dealer that is not guaranteed by U.S. person

A = CFTC rules are applicable

NA = CFTC rules are not applicable

SCX = CFTC rules are applicable but substituted compliance is available with respect to the initial margin that Party X posts (but not the initial margin that Party X collects or variation margin)

SCY = CFTC rules are applicable but substituted compliance is available with respect to the initial margin that Party Y posts (but not the initial margin that Party Y collects or variation margin)

SC = CFTC rules are applicable but substituted compliance is available

The following clarifications should be noted:

- Each of the above references to a “swap dealer” refers to a non-bank swap dealer registered with the CFTC. (The prudential regulators – i.e., the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Farm Credit Administration, and the Federal Housing Finance Agency – have jurisdiction over the margin requirements applicable to bank swap dealers.)

- The proposed rule defines ‘‘guarantee’’ as an arrangement pursuant to which one party to a swap transaction with a non-U.S. counterparty has rights of recourse against a U.S. person guarantor (whether such guarantor is affiliated with the non-U.S. counterparty or is an unaffiliated third party) with respect to the non-U.S. counterparty’s obligations under the relevant swap transaction.[4]

- Substituted compliance is available only in a jurisdiction whose laws the CFTC has deemed comparable. Otherwise, substituted compliance would not be available and the CFTC rules would apply.

- U.S. or non-U.S. status is determined by a particular “U.S. person” definition included in the proposed rule, rather than by the definition used in the CFTC’s cross-border guidance from July 2013.[5] The definition included in the proposed rule is generally similar to the “U.S. person” definition used by the Securities and Exchange Commission in the context of security-based swaps.

[1] Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants, 80 Fed. Reg. 41,376 (July 14, 2015). The CFTC swap margin requirements have been re-proposed and are not yet final. A prior posting in Derivatives in Review (available here) addressed the CFTC’s re-proposed margin rules.

[2] See id. at 41,382, 41,401.

[3] Although this table, for purposes of simplicity, does not refer to major swap participants, the proposed rule would apply to swap dealers and major swap participants in the same way.

[4] Id. at 41,384.

[5] Interpretive Guidance and Policy Statement Regarding Compliance with Certain Swap Regulations, 78 Fed. Reg. 45,292 (July 26, 2013).