Almost a year into the new administration, the U.S. Securities and Exchange Commission’s Division of Enforcement released its annual report last week, providing a recap of the SEC’s enforcement results over the past 12 months, as well as some insight into its direction for the coming year. Overall, the report suggests that the SEC will increase its focus on addressing harm to “Main Street” investors and that pursuing individuals will continue to be the rule, not the exception.

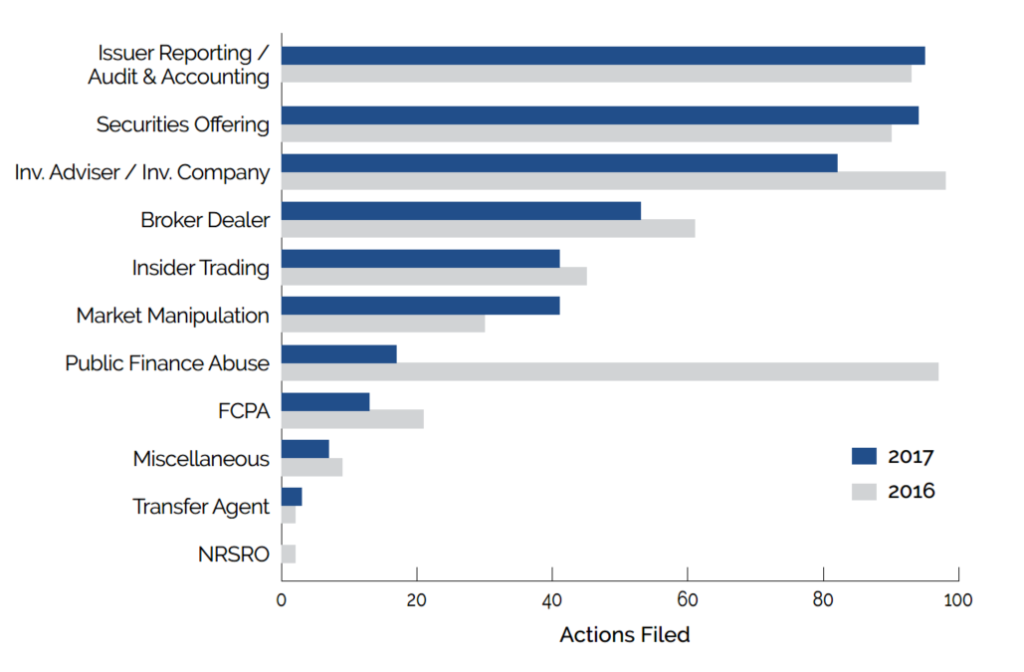

During fiscal year 2017, the SEC pursued 754 enforcement actions, 446 of which were “stand-alone” actions (as opposed to “follow-on” actions which seek to bar executives from practicing before the Commission or to deregister public companies). This represents a drop from the prior year in which the SEC pursued 784 enforcement actions, 464 of which were stand-alone actions. The bulk of the Division’s 446 stand-alone actions in FY 2017 focused on issuer advisory issues, issuer reporting, auditing and accounting, securities offerings, and insider trading—all areas that saw a relatively similar number of cases in FY 2016. Actions involving public finance abuse represented the only significant decrease in the number of cases versus the prior year. In FY 2016, the SEC brought nearly 100 public finance abuse actions compared to fewer than 20 in FY 2017.

Apart from these statistics, the report also provided important clues as to the SEC’s priorities for the coming year. Division Co-Directors Stephanie Avakian and Steven Peikin identified five core principles that will guide their decision-making process over the next year: focusing on the retail or “Main Street” investor, focusing on individual accountability, using cyber-related expertise to combat the growing technological sophistication of wrongdoers, tailoring sanctions to further enforcement goals, and constantly assessing the allocation of the Division’s resources.

The emphasis on retail investors is in line with Chairman Jay Clayton’s mission to protect the long-term interests of the “Main Street” investor (reported here), and it suggests that the SEC will continue its trend of enforcement actions against investment advisors for unsuitable investments, improper or excessive advisory fees, microcap stocks, and other threats to retail investors.

Avakian and Peikin’s emphasis on pursuing individuals will be familiar to many observers in light of the DOJ’s increased focus in recent years on the importance of individual accountability in DOJ prosecutions. This renewed emphasis on individual accountability is reflected in the Division’s enforcement statistics: Over the last year, one or more individuals have been charged in more than 73 percent of the stand-alone enforcement actions the Commission has brought, and, in the six months since Chairman Clayton took office, that figure has risen to more than 80 percent. Avakian and Peikin also stressed the importance of using the Commission’s full range of tools available when considering the appropriate penalties, including seeking admissions of wrongdoing and pursuing monitoring arrangements.

What do the Co-Directors’ statements foreshadow for entities and individuals facing an SEC inquiry or investigation? First, if the alleged wrongdoing touches on retail “Main Street” investors, we may expect to see Enforcement Division action even in those cases where the relevant dollar amounts are not entirely significant. Second, potential targets should continue to assume the SEC will pursue charges against individuals as part of its enforcement strategy. As is often the case, and likely even more so in light of the Co-Directors’ statements, it may be advisable for individuals to seek separate counsel early who can coordinate strategy with company counsel and prevent or defend against individual charges.